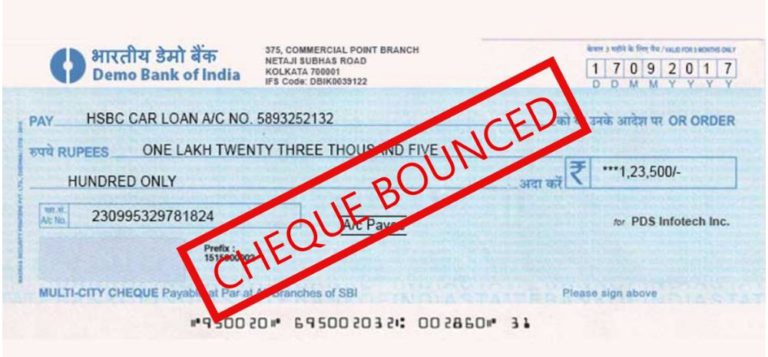

Check bounce impact on CIBIL score:

A check bounce is often considered a small issue but it can have significant consequences. Many people including celebrities, have faced legal battles over bounced checks. When a check repeatedly bounces, it becomes your responsibility to bear the consequences. But did you know that a check bounce can also affect your CIBIL score?

What is a CIBIL Score?

A CIBIL score is a three-digit number that ranges from 300 to 900, representing an individual’s creditworthiness. The score is based on your financial history, EMI payments, and credit card bill clearances. A score above 750 is considered good, while a score below 750 indicates higher risk for lenders.

How Check Bounce Affects Your CIBIL Score

According to Tata Capital, multiple check bounces can indirectly impact your CIBIL report. This is because banks perceive frequent check bounces as a sign of financial instability. If your CIBIL score drops due to this, it may affect your loan eligibility. Banks may be hesitant to approve loans, fearing that you will fail to repay on time.

Consequences of Frequent Check Bounces

Banks keep a close eye on check bounce cases. While a single bounce due to technical reasons might be overlooked, repeated instances can lead to serious consequences. Banks may impose restrictions such as limiting your overdraft facility, reducing your credit limit, or even freezing your account. These actions will directly impact your financial transactions, affecting your business, cash flow, and vendor payments.

Legal Implications of Check Bounces

If a check bounce case reaches court, it can negatively affect your financial credibility. Even if you receive a recovery order, failure to comply can harm your reputation. While a court decision does not directly impact your CIBIL score, it can result in future loan rejections.

A check bounce may seem minor, but its effects on your CIBIL score can be long-lasting. It’s essential to maintain a good financial record to ensure smooth access to loans and credit facilities in the future. Always make sure you have enough funds in your account before issuing a check.

Also Read:Top 7 Movies That Make You Miss Someone You Never Met