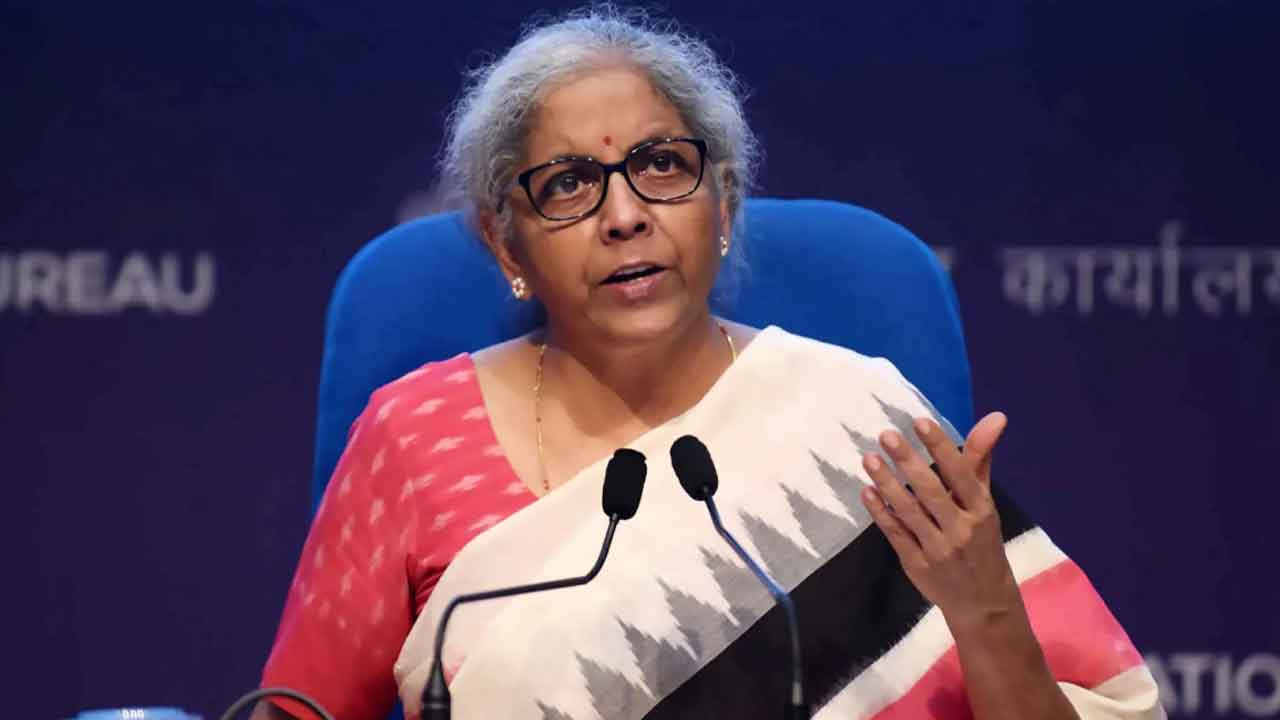

New GST Rates: Finance Minister Nirmala Sitharaman unveiled the major revamp of India’s Goods and Services Tax (GST) framework of changes that have been approved by the GST Council and which will come into effect on 22 September 2025. This move is going to simplify the tax system as well as boost the consumer demand, particularly before the festive season.

The government collapsed the earlier four-tier GST system into just two slabs of 5% and 18%, with a separate 40% rate for luxury and sin goods.

Everyday-use items like soaps, shampoos, toothpaste, and shaving products will now fall within the 5% bracket, thus significantly bringing them down further.

Basic food products like UHT milk, paneer, roti, chapati, and parathas are fully exempt from GST, thus reducing household kitchen costs.

Further, essentials for health care and education, such as essential medicines, medical devices, notebooks, and pencils, are now either moved to 5% or totally tax-free.

GST will no longer be levied on insurance policies, either life or health, giving relief to policyholders.

Consumer durables and vehicles such as air conditioners, televisions, washing machines, two-wheelers below 350cc, cars, buses, and trucks will all be applicable 18%, from earlier 28%, thus making them cheaper.

New Ground Level: 5% only – For Tractors, ” Machinery and Tyres”. All agricultural inputs under which are taxed at this low level.

Despite the relief offered by this reform to many households, some categories will have higher tax rates.

A separate 40% slab will apply to the so-called premium motor cars. All aerated drinks, tobacco products, and other luxury or harmful items.

All high-value apparel sold at ₹ 2,500 and above will now charge 18% GST, compared to the previous 12% levy.

Coal has also gone up to 18% as opposed to the previous 5%.

Also Read: Next-Gen GST Reforms: Full List of New GST Cuts Revealed

According to government estimates, tax cuts could cost the exchequer any amount around ₹ 48,000 crore. However, they expect such a pessimistic figure to compensate with positive ripples in consumption. Economists say the new GST structure should relieve retail inflation by more than 1%. Clearing some air for households already facing steep prices.

Overall, these reforms will simplify compliance and reduce prices for essentials while stimulating consumption. While also discouraging luxury and sin goods through higher taxation.